Tax Savings is Possible

As we’re wrapping up the year, we cannot ignore that this year has been tough for many. The price of eggs might have decreased, but overall food prices, housing and other necessities have gone up at a steady pace. That’s why I prepared some tax scenarios on how we can save at least on federal taxes.

During the summer, the new administration passed the Big Beautiful Bill, which resulted and few changes for individuals and businesses alike. Some of the provisions worth mentioning are the State and Local tax (SALT) deduction, No Tax on Car Interest, and the 100% depreciation on a section 179 asset.

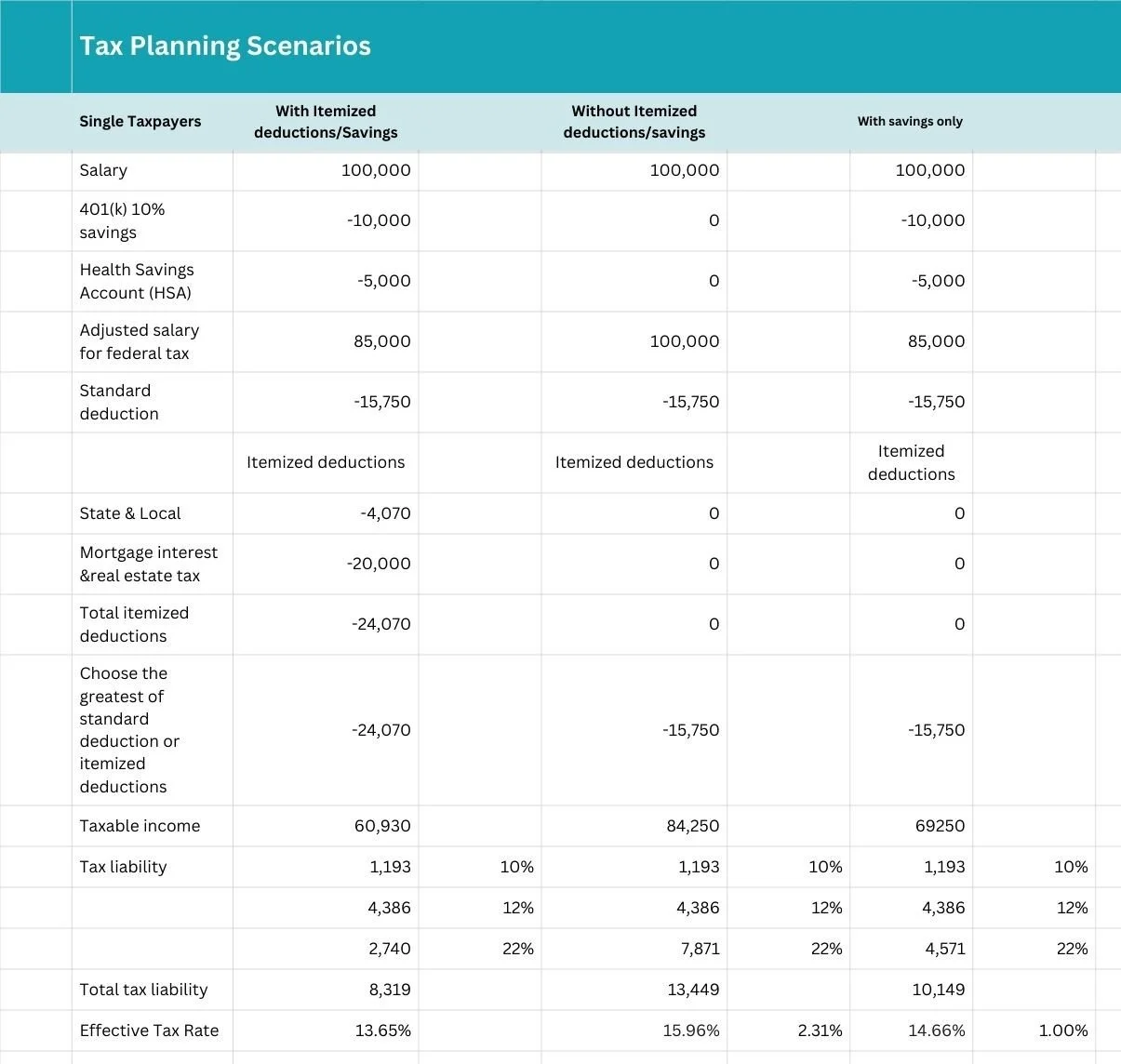

However, in this article I will concentrate on individual taxation. There are ways we can save on taxes specifically by saving for retirement. For instance, a single taxpayer may save approximately $3,300 if she saves for retirement through a 401(k) with an employer program and enrolling in a health savings account. In addition, if the taxpayer owns a home, she can itemize and deduct the mortgage interest, real estate taxes and state and local taxes, resulting on $5,130 in savings. I’ll take that!

Contact me to learn more about how you can maximize your tax savings with tax planning and strategy!

Tax Scenarios for single taxpayers